What's new in Microsoft Licensing and Cloud in August 2024

Alexander Golev and Daryl Ullman discuss the latest developments in Microsoft licensing and cloud cost management. They cover topics such as the upcoming Windows Server 2025 release and Microsoft's financial results for FY2024. Stefan Denk, Head of Cloud, joins the discussion to provide insights into Azure Cost Management features including the new FinOps Open Consumption and User Specification (FOCUS) standard for Azure.

Episode Transcript

Alexander Golev: Welcome to our monthly update, where we'll cover the latest developments in Microsoft Cloud and Microsoft Licensing. Today, we'll also discuss Microsoft's financial results. I'm joined by my business partner, Daryl Ullman. We're also expecting our Chief Cloud Economist, Stefan Denk, to join us later to discuss the recently introduced Azure Cost Management features.

I'll start by presenting the latest news in Microsoft licensing. Then, we'll hand it over to Stefan Denk for an overview of Azure Cost Management. Finally, Daryl will conclude today's event with an analysis of Microsoft's financial year results and their implications.

Microsoft Licensing Update

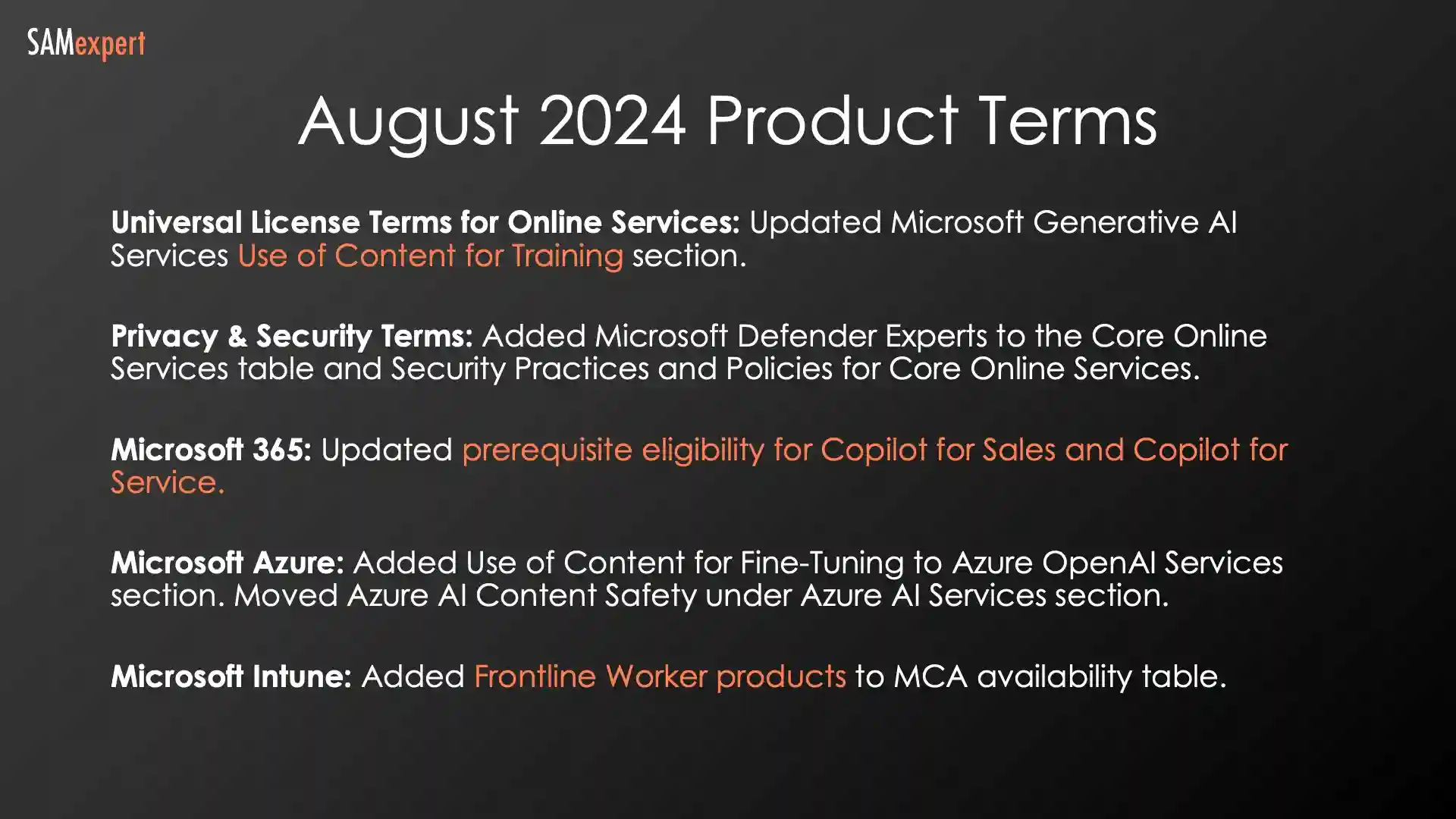

For the third time this year, I must report that August 2024 is another quiet month regarding product licensing changes. There's virtually nothing happening that will significantly impact your budget. Microsoft appears to be holding back on significant updates to its licensing programs, which typically occur around October and April, with occasional mid-year changes like last year's Copilot update.

However, we need to start paying close attention to upcoming Microsoft releases. Windows Server 2025 is a major release expected around October or November, and it's about to bring changes to its licensing model.

Please note that everything discussed today remains unconfirmed until it appears in the official Product Terms around October or November. While this information is not yet official, it reflects the consensus among Microsoft partners and licensing experts.

First of all, Microsoft promises to keep the perpetual licensing model. Despite some expert predictions, Windows Server 2025 is not expected to become subscription-only.

An exciting development Microsoft is bringing to Windows Server is a consumption model. It will allow you to run Windows Server virtual machines and even physical machines connected to Azure Arc on a pay-as-you-go basis. (You'll pay in Azure, but the machines will be on-premises in your data centres.)

We also anticipate the consumption model may be permitted in hosting environments. While this isn't confirmed yet, it's worth noting that SQL Server with Azure Arc on the consumption model is already allowed on hosting. However, for absolute certainty, we'll need to wait for the official release.

Regarding editions, the Essentials Edition has been discontinued. Windows Server 2019 was the last version to include it. The next release, Windows Server 2025, will only offer Datacenter and Standard Editions.

While the new version introduces many new features related to containers, virtualisation, and security, including removing older security protocols, today's focus is not on technical capabilities. Instead, we'll concentrate solely on costs and licensing.

One exciting promise from Microsoft is the introduction of hot patching for Windows Server 2025 on-premises. While already available in the Azure edition, it's not offered for Windows Server 2022 on-premises. There's currently no consensus on how this feature will be licensed. The worst-case prediction is that it will require Software Assurance, meaning it won't function with perpetual licenses. Additionally, it might be offered as an add-on license.

Therefore, to utilise hot patching, you may need to:

Purchase Windows Server.

Subscribe to Software Assurance or acquire Windows Server on a subscription basis.

Potentially pay an additional fee for hot patching.

These are the current expectations surrounding Windows Server 2025.

How much will the pay-as-you-go option be? The exact cost hasn't been released yet. However, based on the pricing of SQL Server with Azure Arc, we can make some estimations for financial planning purposes.

We observed that the pay-as-you-go prices for SQL Server with Azure Arc are approximately 20% higher (per year) than annual subscription licenses. We can get a rough idea of the potential costs by applying this exact estimation to the current CSP price list for Windows Server Datacenter and Windows Server Standard subscriptions.

It's important to explain that we're comparing subscription licenses to pay-as-you-go subscription fees, not perpetual licenses or licenses with Software Assurance. We're looking at the difference between hourly, monthly, and annual subscription models.

Product | Subscription per year, 8 cores | Monthly, 8 cores | Hourly, 8 cores |

Windows Server Datacenter | $2036 | $209 | $0.28 |

Windows Server Standard | $292 | $30 | $0.04 |

While these estimations can help with initial financial planning, remember that the actual pricing may differ at the official release.

What else do we know about Windows Server 2025? There will be no Client Access Licenses (CALs) charged on an hourly basis. It makes sense, as CALs are typically assigned to devices or users, not time-based usage.

Microsoft has consistently required Windows Server CALs, meaning you must license not just the servers but also each client connecting to them. However, with the widespread adoption of Microsoft 365, Windows Server CALs are effectively included in the top-tier subscriptions, making standalone CALs less necessary for many users.

Our analysis of our client base revealed that the percentage of users requiring standalone CALs is minimal. While we can't speak to Microsoft's commercial reasons for continuing to charge for CALs, it's worth noting that they aren't required in Azure, on hosting platforms (including AWS and Google), or with CSP hosters. The only scenarios where CALs are still necessary are on-premises deployments and when bringing your own license to a service provider. These cases are becoming increasingly rare.

Another feature I'd like to see in the new version is the ability to use Windows Server Standard licenses with Windows Server Datacenter virtual machines. It is currently possible with CSP subscription licenses, but not for Enterprise Agreement clients, despite them being a larger and more lucrative customer base for Microsoft. Hopefully, this will change.

These are our expectations for Windows Server 2025.

In addition, we can expect more products to be released. Office 2024 LTSC has been confirmed multiple times, indicating that Microsoft will continue to offer traditional Office, at least for one more version.

Strangely, there's no clarity about SQL Server 2025, even though its release would be expected. Information on this is currently scarce.

FinOps Open Consumption and User Specification

Moving on to Azure Cost Management news, as I mentioned earlier, there's not much happening on the licensing front. However, Microsoft has just rolled out some new Azure Cost Management features, and Stefan Denk, our Head of Cloud, will discuss these.

Stefan Denk: Thank you, Sasha. The big news in Azure Cost Management is the release of the FinOps Open Consumption and User Specification (FOCUS) for Azure. It is a major development that should significantly impact all FinOps professionals trying to manage Azure costs.

The FinOps Open Consumption and User Specification (FOCUS) comes from the FinOps Foundation, a collaborative group of public cloud users from various industries and sectors, including cloud providers like Azure, AWS, Google, and even major SaaS providers like Salesforce.

FOCUS aims to standardise how cloud costs are represented. Currently, each provider has its proprietary format:

Azure has "actuals or amortised consumption."

AWS has its "Cost and Usage Report."

GCP has a similar offering (the name currently escapes me).

These formats, while serving a similar purpose, are high-level and proprietary. They typically provide one line per resource per day (or even per hour in AWS), resulting in colossal consumption records.

Each provider used its own terminology and column names, making it challenging to compare costs across different clouds. The FOCUS standard aims to address this by establishing a unified set of column names. Regardless of whether you're using a virtual machine in Azure, AWS, or Google, you'll always be able to identify it as such.

You'll still be able to discern the specific details, such as whether it's an Azure virtual machine, its subscription and resource group, and its specifications. While the naming and content within the cells may vary across cloud providers, the table structure will be standardised. This standardised structure covers the first 30 or so columns, followed by all the existing columns from the previous usage file formats.

However, they couldn't fit every piece of information into the FOCUS standard. For example, Azure's cost and usage data provides details like the specific OS image used (e.g., Canonical Ubuntu or Windows Server) and the number of CPUs in a VM. This extra information wasn't accounted for in the initial FOCUS standard.

You can still access these details through the "X" fields accompanying the FOCUS standard data. But now, building multi-cloud analysis is significantly easier. You no longer need to harmonise multiple, completely different layouts of the same cost information. The focus shifts to correctly interpreting and pivoting the data across different cloud providers.

While there's still room for improvement, building your own multi-cloud analysis tools has become significantly easier. In our view, this development has dramatically reduced the value proposition of established FinOps tools. A significant portion of their development efforts went into providing a one-stop shop for viewing cloud costs across Azure, AWS, and Google. Now that these providers report using the same data structure, it's worth questioning whether paying an additional 2.5-3% of your monthly Azure consumption for these tools is still justified, especially if their primary use is to get an end-to-end view of your costs across the three major cloud providers.

If that's the sole purpose you're using these tools for, it might be a good time to consider developing your own solution. It would be a justifiable development project, made much more manageable by the FOCUS standard. In fact, you might even be able to achieve this using Excel.

Cost Cards for Virtual Machines

Alexander Golev: Cost Cards for Virtual Machines. Please tell us about that.

Stefan Denk: It is another new feature, currently only available for Azure credit card users (not enterprise users. It aims to provide a better Total Cost of Ownership (TCO) view directly in the Azure portal for your virtual machines. The traditional view only considers the pure cost of the VM plus the licenses if you're using the license-included feature.

We strongly recommend against using the license-included option. The subscription licenses Sasha discussed earlier are significantly cheaper. When running a Windows Server on a virtual machine in Azure, consider getting a subscription license instead of using the license-included feature unless you're only spinning the VM up for a short period. As a general rule, if you're running it for a month or two, a subscription license becomes more cost-effective.

Cost Cards for Virtual Machines aim to provide you with the total cost of a virtual machine, including the attached disks, and potentially even an estimate of the network bandwidth you'll use. The first five gigabytes are free, but after that, you'll be charged eight cents per gigabyte for data pushed out to the internet and a lower rate for data transferred across VNet peerings or to another Azure region.

Microsoft has faced criticism for only showing part of the costs for a VM, particularly in the lower-end consumer or small business market that doesn't fall under an Enterprise Agreement or CSP. Partners were often expected to help these companies understand the complete pricing structure. Microsoft has now addressed this issue for this service, providing a comprehensive cost view.

Estimating the TCO for VMs is relatively straightforward, as you can simply take the VM cost, add the cost of the five disks you need to attach, and then add a small percentage (maybe 5%) to account for network traffic and other unforeseen expenses. Microsoft's new feature makes it easier for users to grasp the true cost of a service as it would be in production on Azure.

It is a positive trend and development overall. Hopefully, Microsoft will extend this approach to other services, offering estimation tools within the Azure portal during the solution-building process. It will help companies better understand the final cost impact before deploying their solutions to the cloud, avoiding "bill shock" surprises later on.

AKS Cost Insights

I very much welcome the direction Microsoft is taking with the new AKS Cost Insights feature, and I sincerely hope they extend it to more solutions with a shared services nature.

The consumption overview from Microsoft, which I affectionately call the "line-by-line mobile phone bill from hell," can have millions of entries per month, often overwhelming people. Faced with a CSV file that even Excel refuses to load due to its excessive rows, the FinOps and cost management community is often forced to rely on specialised tools.

Alexander Golev: So, they've effectively rolled out a feature that helps you, specifically on these clusters, allocate costs between different cost centres.

Stefan Denk: That's correct. Microsoft has looked at Kubernetes and recognises two main ways to build your Kubernetes environment. One approach is to assign each application its own subscription or resource group, requiring you to deploy a cluster of three or more VMs per application. However, this isn't the most cost-efficient method.

Like traditional web servers, the essence of Kubernetes is to have a farm that runs multiple applications. You want to deploy numerous containers and diverse workloads on a single large cluster with potentially 5, 50, or even 500 nodes for high resilience. It allows you to drain a few nodes for patching or maintenance without compromising the cluster's overall stability due to its ample capacity.

However, this approach leads to a huge cluster where you only see the cost per VM per day. The new solution addresses this by providing a cost distribution key for AKS clusters, enabling you to associate the costs of the large cluster with the individual components running on it. It is crucial for showback and especially for chargeback, as it allows you to split a single line in the Azure cost and usage record into multiple lines, attributing portions of the cost to the components it supports.

We would love to see Microsoft expand this functionality to other large shared services like SQL databases and Data Lakes, enabling precise showback and chargeback. However, if you currently need to implement detailed showback and chargeback for such services, we're happy to assist you in figuring out how to achieve the same outcome.

Alexander Golev: Stefan, thank you very much for the update.

Stefan Denk: A pleasure. Thank you.

Microsoft FY2024 Summary

Alexander Golev: Daryl is back to discuss Microsoft's financial year 2024 summary. You may be aware, if you're familiar with Microsoft, that Microsoft's financial year ends on the 30th of June. We can now look back at Microsoft's financial year 24, and, as we're already in the year 2025 in Microsoft terms, we can try to predict how it will affect us. Daryl, it's back to you.

Daryl Ullman: Okay, thank you, Sasha. This time of year, during the summer, provides an excellent opportunity to reflect on the previous year. Again, the previous year, as Sasha pointed out, is Microsoft's fiscal year 24, which ended at the end of June, and they've already kicked off the 1st of July, their fiscal year 25.

For those of you new to the Microsoft business or who have taken on a new role, it's important to be aware of this detail. From a negotiation perspective, it's always good to know when the counterparty's end of the financial year is, not only for Microsoft but for any vendor you're talking to, working with their fiscal years. Those are spread over the various periods of the calendar year, so just be aware of that.

Why is it essential for procurement experts, technical professionals, Azure professionals, Software Asset Managers, or CFOs to reflect on Microsoft's finances? You might think, "I don't deal with Microsoft's finances. I don't care how much they're making or where they're making money. It won't affect my life."

However, understanding Microsoft's financial performance, particularly its successes and challenges in specific areas, can provide you with valuable insights and negotiation leverage. Knowing where their focus will be in the coming year can help you anticipate their priorities and tailor your strategies accordingly.

As someone who negotiates audits, Enterprise Agreements, CSP contracts, and MACC agreements on a daily basis, I can attest that knowledge is power. The more you know, the better prepared you'll be. So, I'll guide you through the macro-level financial picture and then pinpoint how you can apply this knowledge in your day-to-day interactions with Microsoft, negotiations, and internal discussions within your organisation.

Let's start with a high-level overview of Microsoft's fiscal year. From their perspective, the results were excellent. Microsoft segments their business into three categories: Intelligent Cloud, Productivity and Business Processes, and More Personal Computing.

Let's start with Intelligent Cloud. What's included in Intelligent Cloud is Azure, Windows and SQL Server, GitHub, and some additional products such as AI. So, if you're going to ask me as we go through, how well is Microsoft doing with AI? I'm going to tell you there are no actual numbers out there. Microsoft hides the granular information under the Intelligent Cloud segment. I'll give you my best, almost best, guess based on what we are seeing in the market in a minute. And that will help you with your upcoming FY25 or Microsoft's FY25 discussion.

We'll begin with Intelligent Cloud. This segment includes Azure, Windows and SQL Server, GitHub, and other products, including AI. If you're wondering how Microsoft is performing with AI, no specific numbers are available, as Microsoft hides the granular information under the Intelligent Cloud segment. I'll provide my best estimate based on market observations, which could be useful for your upcoming discussions about FY25, both yours and Microsoft's.

Let's start with Intelligent Cloud's fiscal year revenue of 109 billion dollars—a considerable number. But what's interesting is that it's a 20 per cent year-on-year growth. Look at the percentage growth. Microsoft is a huge company, so the numbers can be intimidating. The 20 per cent is what's interesting. From that growth, Azure is 30 per cent. So, just keep in mind where the growth is.

Intelligent Cloud generated a substantial revenue of $109 billion in the last fiscal year—a considerable number! But what's interesting is that it's a 20% year-on-year growth. Microsoft is a huge company, so the absolute numbers can be intimidating. Focus on the percentage growth instead. Azure accounts for 30% of this growth, so keep in mind where the momentum lies.

Azure is driving the growth, and you're likely experiencing this firsthand. When interacting with Microsoft, the emphasis is on Azure, particularly around consumption. It ties back to Stefan's earlier points about potential overspending or undermanagement of Azure infrastructure and servers. From your perspective, there's significant room for optimisation.

The 30% growth stems from various factors, including new workloads, increased demands on databases, bandwidth, CPU, core usage, and the adoption of additional services.

However, the third and often underestimated driver of Microsoft's growth is customer waste. We consistently observe an average of over 30% waste. By waste, I mean scenarios like leaving the lights on while you're on vacation and still paying the electricity bill. Or your kids coming home, turning on everything, and leaving the house, causing your bill to skyrocket without any added value. You haven't expanded your house or added another child; you're simply misusing the utility, in this case, Azure. And Microsoft is capitalising on it. So, a portion of that 30% growth is directly attributable to your waste.

Next, let's look at Productivity and Business Processes. It's always surprising to me that Office continues to grow. It's been growing for the past 30 years, and it's still growing as part of Office 365. As you can see, there's a 13% overall growth in this segment, which includes Office 365, LinkedIn, and Dynamics. We sometimes underestimate Microsoft Dynamics, but it's a significant part of their business.

Office 365 remains the most significant contributor to the Productivity and Business Processes stream, with 14% growth attributed to Microsoft 365. Much of this growth is tied to licensing, specifically the shift from E3 to E5 and the continuous addition of new security components.

Even if you're already on E5, you're likely using numerous add-ons, further fueling Microsoft's growth. Unlike in the past, when audits were a major driver of Office growth, the focus now is on delivering added value, mainly in security and productivity. This strategy is positively impacting Microsoft's bottom line.

We'll soon examine the growth predictions for FY25 and see where Microsoft is heading with this.

In "More Personal Computing", there's the good old Windows operating system, specifically OEM licenses. While we may have forgotten about OEM, it remains a significant source of revenue for Microsoft. It's a reliable cash cow, as almost every machine sold still comes with a Microsoft Windows OEM license.

This segment generates substantial revenue for Microsoft. The "More Personal Computing" segment also encompasses Xbox, search, and advertising, contributing to a total revenue of $76 billion. From my experience with Microsoft over the years, I believe most of this revenue still originates from the Windows operating system.

The Windows operating system continues to be a cash cow and a highly profitable business for Microsoft. A 14% growth is impressive, and while 61% of that growth comes from Xbox and content, the Windows operating system remains the primary revenue driver in this segment.

From a stock perspective, which ultimately matters to investors, Microsoft saw a 25% growth in its stock price. That's huge. In FY23, 12 months ago, the stock was $320; today, it's $399. Furthermore, the dividend per share has grown by 10%, one of the highest dividends from a major tech company. Microsoft is a well-established company, yet its overall revenue is enormous, and the growth is substantial and continuous.

What does it mean for you? It means that Microsoft is making money. And you know what? That's a good thing. It's a good thing because they can reinvest in Research & Development. They can provide better products, and they do provide good products. Even though we are on the other side of the negotiation table from Microsoft and represent our customers, we are very much aware of where Microsoft puts its dollars.

What does this mean for you? It means Microsoft is profitable. And that's a good thing because it enables them to reinvest in R&D and develop better products, which they do. Even though we are on the other side of the negotiation table from Microsoft and represent our customers, we are very much aware of where Microsoft puts its dollars.

Understanding where they invest their resources allows you to pull the right levers and strategically influence negotiations. Microsoft's success puts pressure on them to maintain and even exceed their performance year after year. Consequently, your account team is likely under increased pressure to sustain the double-digit growth.

Even if your account seems small compared to the billions of dollars in Microsoft's revenue, you still matter to your account representative, the account team, and the geography. Remember, you have leverage, regardless of Microsoft's size or your size relative to them. Keep that in mind.

So, let's look at the total numbers. It's always lovely to see. It's pretty big, $245 billion, not a lousy revenue outcome, 16 per cent year-on-year growth, meaning again, going back to what it means to you, you will see the pressure coming in from their account reps. Again, they need to keep up these double-digit numbers because if they don't bring the double-digit numbers, the stock price is going to drop, and investors aren't going to be happy.

Now, let's examine the total numbers. It's always lovely to see. Microsoft generated a substantial revenue of $245 billion, demonstrating a 16% year-on-year growth. What does it mean to you? You will likely see and feel the pressure their account reps are facing. They need to maintain these double-digit numbers because failing to do so could lead to a drop in stock price and unhappy investors.

Operating income remains very high at $109 billion, a 24% increase year over year. This strong performance suggests that Microsoft is managing its business effectively. Again, what does this mean for you? It means you're partnering with a company that understands how to run a business. They're not wasting money; they're generating profit and reinvesting it in R&D.

When investing the future of your business in Microsoft or any other company, it's crucial to understand their stability. You don't want to bet your business on a company experiencing financial losses or declining operating income. You need a stable partner. Microsoft demonstrates stability, high profits, and an increasing operating income. Net income is up by 22%, diluted earnings per share are up by 11.8%, and dividends are also increasing. Overall, Microsoft appears to be in good financial health.

From your perspective, this means you can confidently continue investing in Microsoft technology. However, remember that you still have room to negotiate. You don't have to accept their initial asking price or the list price. The more effectively you present your business needs and priorities to your account team, the better your outcomes will be.

Microsoft's Outlook for FY25

Turning to the outlook for FY25, it's important to note that I'm not a financial analyst. The actual financial experts predict 12 to 15 per cent year-on-year growth. This growth is expected to come primarily from the cloud and AI segments, which is substantial, especially considering the double-digit growth target. Expect the Microsoft team to be proactive this year, doubling down on Azure and tripling down on AI. These areas are crucial for their continued success.

Don't let this opportunity pass you by. Leverage it for the low and the basic services you're still using. Leverage it on your Office 365 expenditure and your unified support contract. Everything is interconnected; it's a web of various components. To see the bigger picture, you need to consider your Unified Support, EA, MACC, and CSP accounts together.

Earnings per share (EPS) are also projected to have double-digit growth, ranging from 15 to 18%. Some key initiatives to watch for include:

AI integration: Microsoft will intensify its efforts to integrate AI into Dynamics, Office, and the broader ecosystem. While potentially making it harder to move away from the Microsoft platform, this strategy could also pose a risk.

Increased competition in security: The recent security incidents have played into Microsoft's hands, but security remains a significant potential risk for them.

Governmental and EU regulatory challenges: These have always been challenging for Microsoft. However, the pressure is currently more focused on Google. While Microsoft faces challenges, the regulatory risk appears to be relatively low. You cannot leverage much from this perspective unless you're a cloud service provider competing with Microsoft. In that case, regulatory scrutiny on Microsoft could benefit you as someone else is looking out for your interests.

On Acquisitions, just keep in mind some of the most predominant ones:

A huge one in gaming and entertainment: Activision Blizzard, for a whopping $68.7 billion. This massive investment underscores Microsoft's commitment to "doubling down" its presence in the Xbox and gaming sectors.

Nuance Communications and AI Healthcare: a substantial acquisition, nearing $20 billion.

A smaller acquisition around advertising technology, valued at $1 billion.

And I'm sure there will also be some big surprises in store. Microsoft is always full of surprises, so I look forward to seeing what they have planned next.

Quick summary: Microsoft had a solid performance in FY24. However, FY25 might be challenging due to the high expectations for double-digit growth (12-15%). This pressure will impact the entire Microsoft organisation from the top down. We can anticipate strategic acquisitions in areas like AI, gaming, and security to maintain growth. Azure also holds immense growth potential for both Microsoft and its customers.

Notably, there's significant room for optimisation within Azure. You can achieve substantial growth (25-40%) in Azure usage while keeping your expenditure flat. It's not rocket science; it's simply good, old-fashioned management. You need to actively manage your Azure assets to prevent unnecessary spending.

Be mindful of the Azure Marketplace, which has become a grey area for many organisations. We've seen CFOs lose control of their spending in this area due to a lack of procurement control and governance.

Additionally, the removal of Teams from Microsoft 365 will affect some customers, particularly those making new net purchases. New Copilot versions and double-digit price increases across Dynamics 365 are also on the horizon, starting in October. Be aware and prepared for these changes.

Thank you.

Alexander Golev: Daryl, I have a question for you, and this is purely speculative since you're not a financial advisor. I've been following economic news around blue-chip companies like Oracle and Microsoft. Correct me if I'm wrong, but there seems to be a magical number for year-on-year net income growth that investors expect: 20%.

Microsoft experienced fantastic spikes last financial year, with up to 30% growth. You've already mentioned it will be challenging to sustain that. It's hard to say if they have any tricks up their sleeve to maintain such momentum, especially considering they've been doing this for three years. The share price has grown by a remarkable 58% in that time.

Looking at their current strategies, like charging for add-ons, making Teams commercial, and introducing Teams Premium, coupled with the fact that audits are less prominent now, it seems they're seeking new revenue streams. If Microsoft's growth slows down, they'll need to find other ways to increase revenue.

What are your thoughts on this? What options do they have? Feel free to speculate.

Daryl Ullman: I believe we'll see growth. I anticipate two main drivers of this growth. First, there's security. We can expect an increase in E5 market share. The Office 365 package remains a substantial component of Microsoft's growth; we've seen a 14-15% growth. It will likely continue to grow through additional security enhancements. That's my personal opinion.

Second, there's AI. We've all seen the price of Copilot. It's enormous, a premium price on top of M365, almost equal to the price of an E3 license. That will continue to grow and drive Microsoft's growth. We're going to see a lot more around AI, with new components and bundles emerging. I have no doubt about that. AI is a massive growth engine.

I think the second growth engine, and I'll be blunt, is poor management by enterprise organisations. I apologise for being blunt. I deal with this daily. When I talk about waste, Microsoft is capitalising on the fact that organisations don't know how to manage their infrastructure effectively, not that they intentionally mismanage it. The tools and practices aren't mature enough, and the market lacks the knowledge to manage these vast, multi-million-dollar Azure infrastructures.

We work with customers spending tens of millions, if not more, per month on Azure. Managing that is vastly different from managing a traditional data centre. It requires a whole new set of tools and a completely different management infrastructure. When engineers have free rein to set up whatever machines they want, aiming for excessive redundancy beyond what's necessary, it leads to hundreds of thousands of dollars in wasted monthly spending.

Microsoft is an aggressive company, and they're aware of this waste. They know it will continue to grow. You must take control if you want to be proactive and avoid contributing to their easy growth. It's not easy, but it's your responsibility. That's where Microsoft will see growth, and your biggest opportunity for savings lies in better managing your Azure, GCP, and AWS consumption.

Alexander Golev: We have a comment from the audience, "The growth will be about 20-25 per cent."

Daryl Ullman: I don't think that's bad, as long as you maintain control over your budget. Microsoft remains strong, outperforming traditional blue-chip companies like IBM and Oracle. In my opinion, they're even in a better position than AWS.

Audience Questions

Alexander Golev: I'd like to address a question from the audience: "If a customer has one subscription through CSP and another development subscription directly with Microsoft, can they open a support ticket with Microsoft for both?"

There are contractual requirements to consider. CSP subscriptions must be supported by the Tier One CSP provider in the chain. If the customer is "indirect" and purchasing through a Tier Two provider, that partner can help them open a ticket with the Tier One CSP. The Tier One CSP can then escalate it to Microsoft if they have a partner support subscription.

The primary support channel for CSP subscriptions is the Tier One provider. Following the common Microsoft support practice, I assume that subscriptions purchased directly from Microsoft should be supported directly by Microsoft. However, you may have to buy an Azure Support Plan, starting from $100 per organisation per month.

Outro

Thank you all for joining us today. We hope you'll be with us again in the coming months for our Q&A sessions every first Wednesday of the month.

Additionally, you can find audio events on various Microsoft-related topics, including negotiations, cost management, and the cloud, on my and Daryl's LinkedIn profiles almost every week. We'll also be introducing more Azure cost management-focused live events in 2025.

On my LinkedIn page, I frequently discuss service providers and licensing for IaaS and SaaS, as well as how to manage them effectively.

If you're new to our channels and have stayed with us until the end, we encourage you to subscribe and learn from our shared insights.

Thank you again, and have a wonderful rest of your day.

Daryl Ullman: Thank you everyone.

Connect with Our Experts

Provide your details and describe your challenges, and a senior expert will get back to you shortly.

Would you like a call instead?

Ready to discuss your Microsoft licensing needs? Book a call with us today! Our experts will provide personalized guidance to help you navigate Microsoft’s licensing options, ensuring compliance and optimizing your software investments.