Summary

The Evolution of Software Licensing

Software licensing has evolved dramatically since the early days of floppy disks and perpetual licenses. What began with Microsoft’s early licensing models in the 1980s has grown into a multi-trillion-dollar global software economy, now dominated by cloud computing and Software-as-a-Service (SaaS).

Let’s remember the key milestones, licensing metric changes, and market dynamics that have shaped software licensing over time.

1980s: The Birth of Software Licensing

1981: Microsoft released MS-DOS, sold to IBM under a licensing model rather than a one-time sale. It is widely remembered as one of the first strategic uses of software licensing at scale.

1985: Microsoft launched Windows 1.0, issuing end-user license agreements (EULAs) to formalise usage restrictions and combat software piracy.

Hardware-based Licensing Controls Introduced: To combat unauthorised duplication, many software vendors began using hardware restriction mechanisms, such as:

Dongles (USB or parallel-port hardware keys required to run the software)

Software protection plugs, often used in high-value software such as CAD or engineering tools.

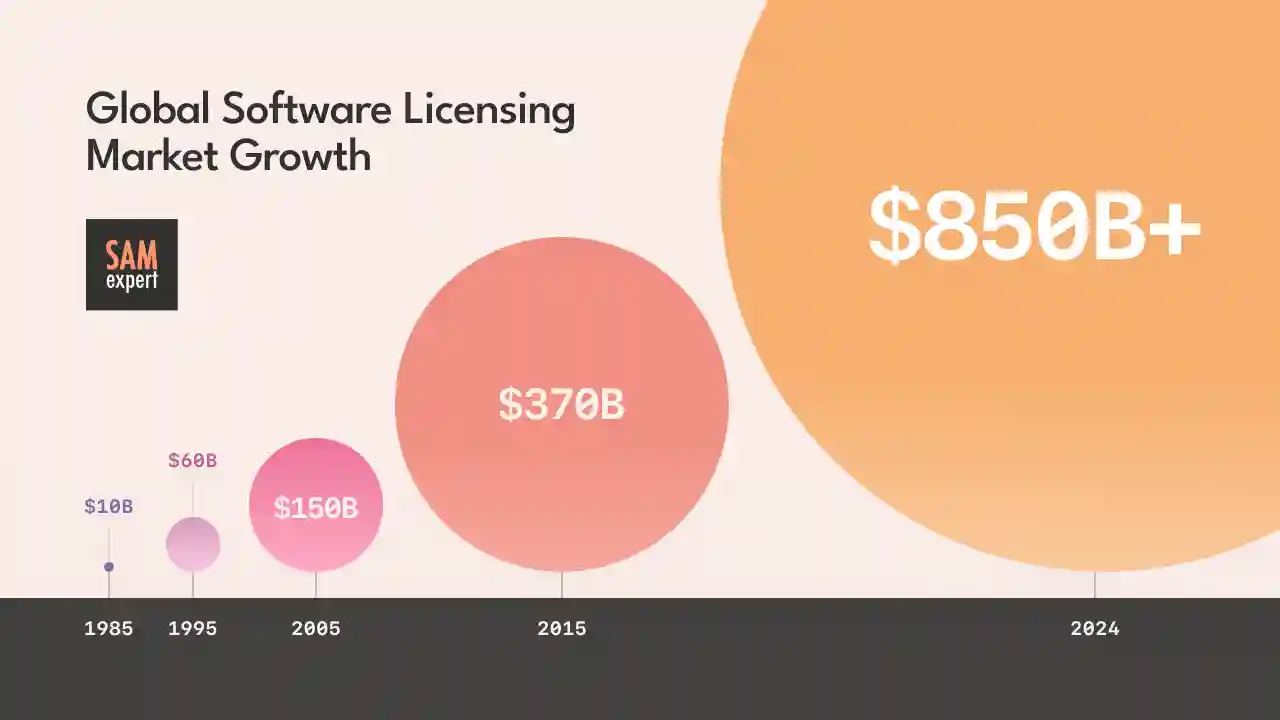

Licensing Metric: Perpetual licenses tied to individual devices, often enforced via physical dongles. Market Size (1985): ~$10 billion globally.

1990s: Perpetual Licensing Becomes Standard

Vendors like Microsoft, Oracle, SAP, and Autodesk adopted perpetual licensing models with optional support or maintenance fees.

Hardware dongles remained common in high-value niches like design software and medical imaging.

Volume Licensing Programs (e.g., Microsoft Select, Enterprise Agreements) became standard for large enterprises.

Licensing Metrics Expanded: Per-user, per-device, per-CPU. Market Size (1995): ~$60 billion globally.

2000s: Rise of Subscription Licensing

The rise of internet-enabled hosted applications and web-based services.

Microsoft Software Assurance (2001) introduced recurring revenue via upgrade rights.

Vendors like Adobe began phasing out perpetual licenses in favour of subscriptions.

Online license validation started replacing physical dongles.

Licensing Metric Shift: From perpetual to subscription-based (e.g., per-user/month). Market Size (2005): ~$150 billion globally.

2010s: SaaS and Cloud Licensing Take Over

Cloud computing became mainstream (AWS, Azure, GCP).

Microsoft introduced Office 365 / Microsoft 365, fully subscription-based.

Licensing enforcement shifted to cloud-based telemetry and identity management.

SAM tools replaced hardware-based enforcement.

Licensing Metric Shift: Consumption-based, user-based, hybrid. Market Size (2015): ~$370 billion globally.

2020s: Cloud Commitments, AI & Platform Licensing

Multi-year cloud commitments dominate large enterprise contracts.

AI licensing (e.g., Copilot, API tokens) introduces new consumption models.

FinOps and SaaS management platforms become essential disciplines.

Market Size (2024): ~$850 billion:

SaaS: ~$260B

IaaS/PaaS: ~$270B

Enterprise Software: ~$320B

🖐 Cloud cost reduction and FinOps strategy support. Learn more: Microsoft Azure Cloud Cost Optimisation.

Licensing Timeline Summary

Year | Licensing Type | Metric | Key Features | Market Size |

|---|---|---|---|---|

1985 | Perpetual (EULA) | Per device | Introduction of dongles/software plugs | $10B |

1995 | Volume Licensing | Per user/per device/CPU | Hardware enforcement still common | $60B |

2005 | Subscription Licensing | Per user/month | Online activation replacing dongles | $150B |

2015 | Cloud + SaaS Licensing | User + consumption-based | Telemetry-based enforcement, SAM tools | $370B |

2024 | SaaS + AI + Commit Bundles | Users, usage, platform commits | Identity-based licensing, FinOps | $850B+ |

2025–2030 Outlook: What’s Next in Software Licensing?

The software market is expected to exceed $1.2 trillion by 2030, driven by AI platforms, industry-specific SaaS applications, and tighter integration between infrastructure and software layers. The licensing landscape will continue to evolve along several key trends:

AI-Driven Licensing Models Licensing will shift toward usage-based metrics for AI and ML services — e.g., per token, per query, or transaction. Expect tiered consumption models and metered billingto become the norm.

2. Dynamic and Real-Time Licensing Licensing will become dynamic and elastic, with real-time usage tracking and self-optimizing license allocation powered by AI.

3. Bundled Cloud + SaaS + Services Commitments Vendors will sell end-to-end commercial bundles (SaaS + Cloud + Support + Consulting) tied to multi-year financial commitments.

4. Compliance-as-a-Service and Smart Contracts Licensing could adopt blockchain-based smart contracts, offering tamper-proof tracking and automated compliance enforcement.

5. Market Expansion Forecast (2030) • Global Software Market: ~$1.2 trillion • SaaS: ~$400–450 billion • IaaS/PaaS: ~$500 billion • AI Platforms: ~$200–250 billion

🖐 Microsoft contract terms optimisation service. Learn more: Microsoft Azure Contract Negotiation.

The Shifting Sands of Software Licensing

The journey of software licensing has been nothing short of transformational — from floppy disks and dongles to cloud telemetry and AI token billing. Each shift mirrored broader economic and technological waves. Today, licensing is not just a legal document — it is a strategic asset that influences IT spending, vendor power, and innovation velocity.

Predictions, Pivots, and the Rise of a New Licensing Era

Will Cloud Repatriation Gain Traction?

Yes. Due to compliance, cost, and performance needs, many organisations will rebalance workloads between cloud and on-premises.

Will AI Be the #1 Growth Driver?

Yes. AI is becoming the fastest-growing consumption layer, with new licensing units (per token, inference, model access).

Is Crypto Licensing Coming?

Possibly. Smart contracts on blockchain could automate enforcement and payment, especially in decentralised ecosystems.

Will SAM and IT Licensing Teams Disappear?

No. They’ll evolve into FinOps, Commercial Strategy, and AI licensing analysts — more strategic, cross-functional, and tech-enabled.

The final chapter has yet to be written.

Licensing will be a major wealth driver this century. Tomorrow’s licensing may be written in code, signed by smart contracts, and executed in milliseconds — but its impact will echo in boardrooms and balance sheets alike.